According to the U.S. Environmental Protection Agency, 13% of current U.S. emissions of greenhouse gases are from buildings1, mostly from burning natural gas and wood to heat the air inside, heat water, cook, and burn in fireplaces.

Those emissions can be reduced to some extent with improved heating efficiency from better insulation and plugged leaks. But far greater reductions can be attained by replacing gas and wood with electricity, particularly heat pumps for both heating air2 and water3, and magnetic induction for stovetop cooking4. In addition to reducing greenhouse gas emissions, heat pumps and induction stovetops avoid the health impacts of indoor combustion5 and cost less to operate6 (particularly in the Pacific Northwest, where electricity rates are low).

The switch to electric can be achieved with bans on the installation of gas and wood heating and cooking systems, or with incentives that give consumers choice.

In Washington State, the Building Code Council has banned gas heating systems in new construction7, and the state legislature is considering a ban on installation of gas heating systems in existing buildings8.

But what about gas heating systems that already exist in buildings? Removal by dictate is not acceptable. But incentives can influence the decision on how and when to replace aging heating and cooking systems while preserving consumer choice.

A price on carbon will tilt the decision away from natural gas. The Washington State Clean Energy Transition Act9 will make natural gas increasingly more expensive over the next few decades.

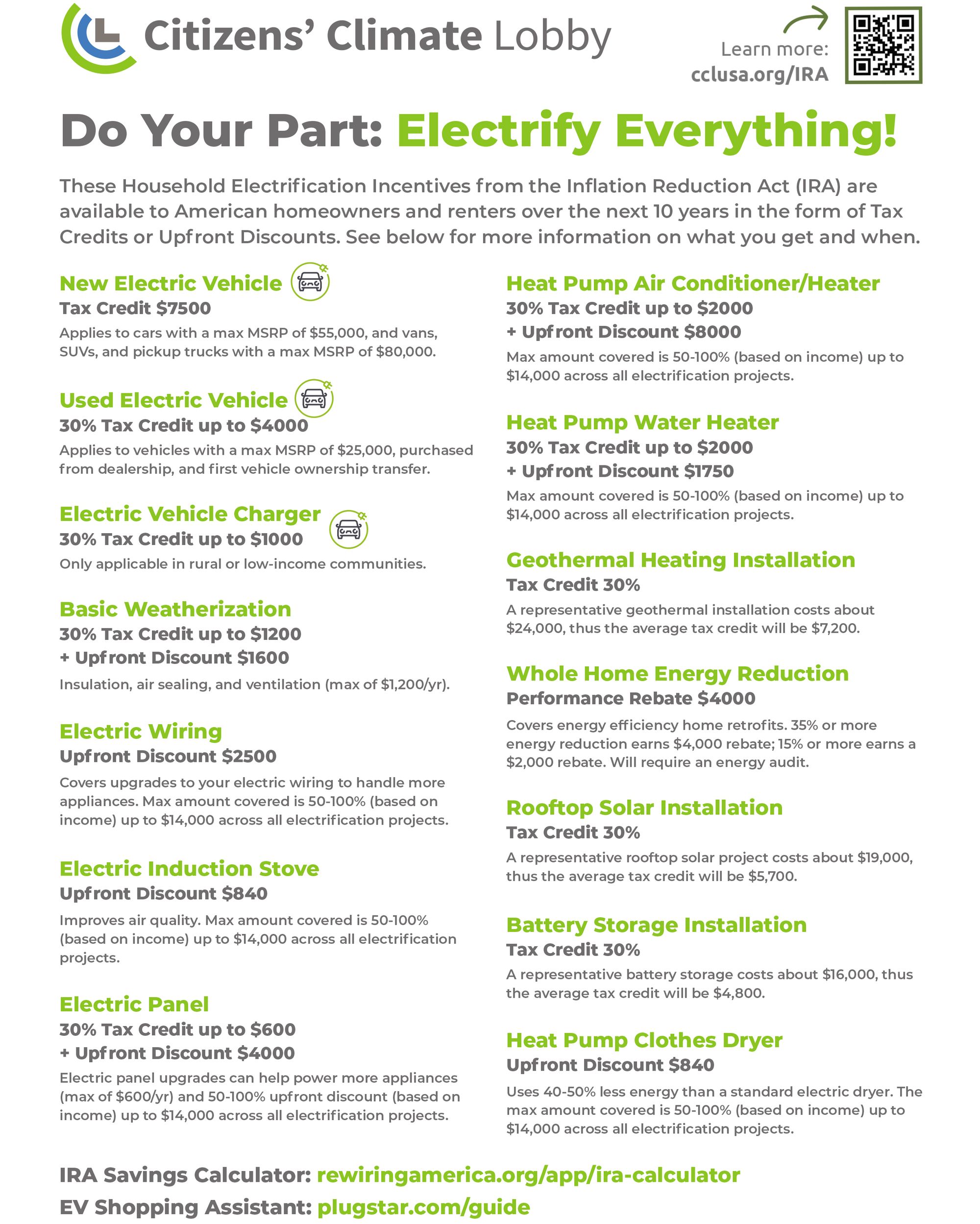

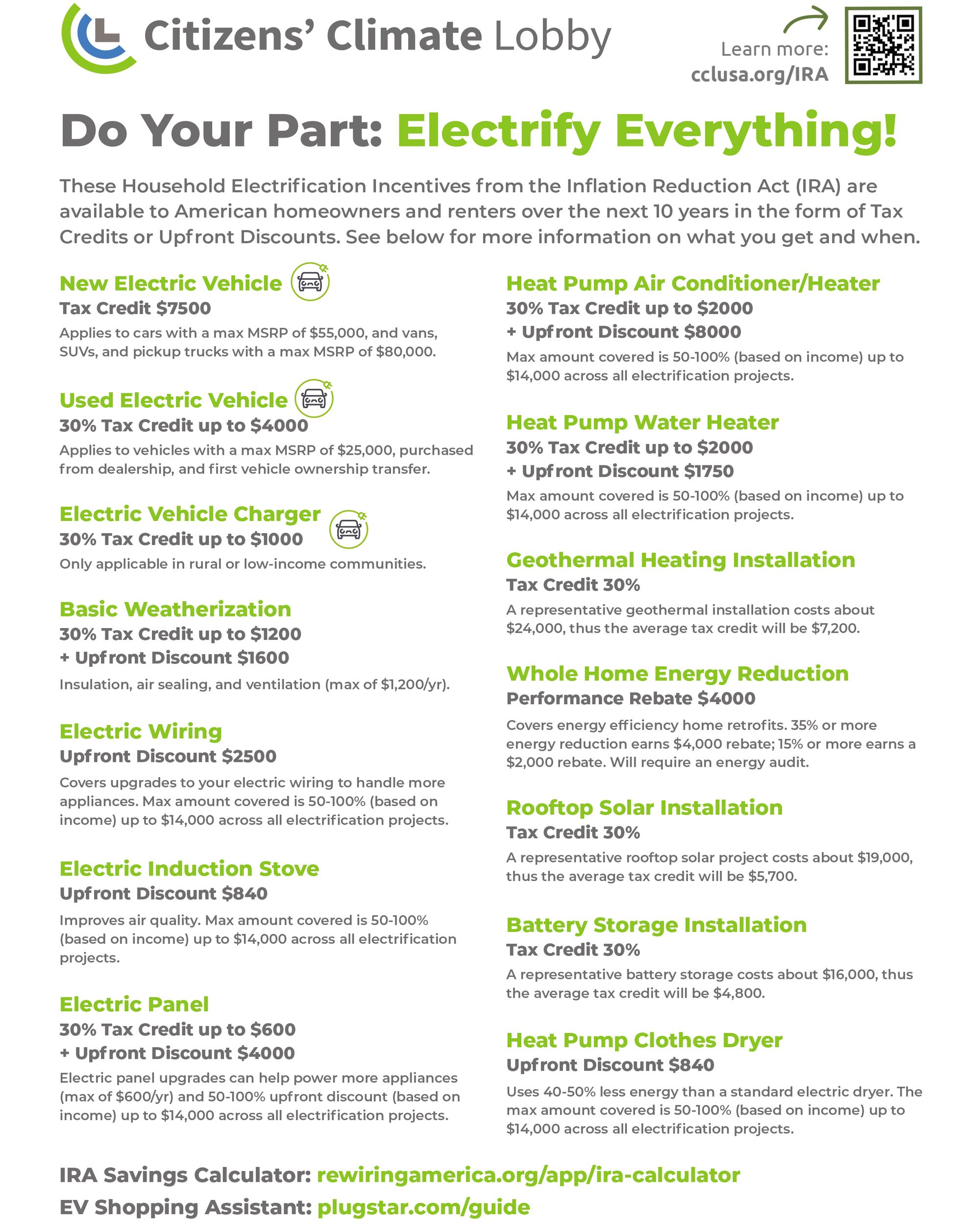

To lower the financial barriers to weatherization and switching to electric heating and cooking, the federal Inflation Reduction Act10 of 2022 provides generous subsidies for building weatherization and installation of electric heating and cooking systems in new and existing homes and commercial buildings11, either owned by the occupant or a landlord12. The subsidies come in the form of federal tax credits, which are available now, and rebates, which are being handled by the states and will be available later this year. The figure below lists the many tax credits and rebates, which depend on income. I also recommend Rewiring America’s IRA Savings Calculator13, which considers both income and homeowner status.

Sources

- https://cfpub.epa.gov/ghgdata/inventoryexplorer/

- https://www.energy.gov/energysaver/heat-pump-systems

- https://www.energy.gov/energysaver/heat-pump-water-heaters

- https://www.whirlpool.com/blog/kitchen/what-is-an-induction-cooktop.html

- https://www.scientificamerican.com/article/the-health-risks-of-gas-stoves-explained/

- https://www.pickhvac.com/hvac/furnace-vs-heat-pump-cost/

- https://ieefa.org/articles/washington-state-moves-require-heat-pumps-new-residential-construction

- https://lawfilesext.leg.wa.gov/biennium/2023-24/Pdf/Bill%20Reports/House/1589%20HBA%20ENVI%2023.pdf

- https://www.commerce.wa.gov/growing-the-economy/energy/ceta/

- https://www.energy.gov/energysaver/articles/inflation-reduction-act-2022-what-it-means-you

- https://www.bdo.com/insights/industries/real-estate-construction/inflation-reduction-act-costs-and-benefits-for-real-estate-construction

- https://www.tenantcloud.com/blog/how-the-inflation-reduction-act-of-2022-can-help-landlords

- https://www.rewiringamerica.org/app/ira-calculator

Steve Ghan leads the Tri-Cities Chapter of Citizens Climate Lobby.